Debt Consolidation Loans in South Africa

If you are managing multiple debts, a debt consolidation loan may help you combine them into one repayment. This can make budgeting easier and reduce the stress of keeping track of different due dates. FatCat Loans helps you review lender options and apply online through a secure process. Loan terms and approval depend on affordability checks and lender criteria.

Why Choose FatCat Loans for Debt Consolidation

We help South Africans find consolidation loan options that suit their budget:

- One Monthly Payment: Combine multiple debts into one repayment plan.

- Clear Loan Terms: Review interest rates, fees, and repayment periods before choosing a lender.

- Flexible Repayment Options: Many lenders offer repayment terms from 6 to 72 months

- Online Application: Apply securely online with supporting documents.

- Options for Different Credit Profiles: Some lenders may still consider applications from borrowers with a low credit score.

What Is a Debt Consolidation Loan?

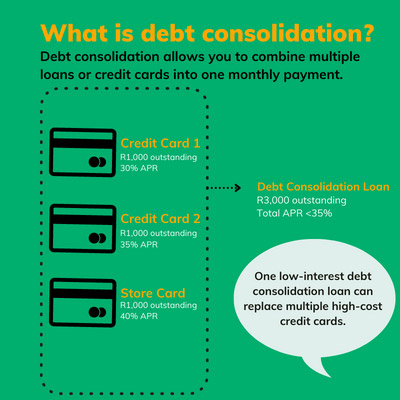

A debt consolidation loan is used to combine existing debts into one new loan. This may include credit cards, store accounts, overdrafts, and personal loans. Instead of paying multiple lenders each month, you repay one loan with a fixed repayment plan.

Debt consolidation loans are often used to simplify repayments. They may also help you reduce your total monthly repayment, depending on the loan terms offered. If you are already using instalment repayments, you can also explore our instalment loan options.

Top Questions About Consolidation Loans in South Africa

What debts can I consolidate?

Many borrowers use debt consolidation loans to combine credit card balances, store accounts, personal loans, and other unsecured debts. Each lender may have different rules, so always check what can be included.

What types of consolidation loans are available?

Common debt consolidation options include:

- Unsecured Consolidation Loans: Often used for credit cards, store accounts, and smaller debts.

- Secured Consolidation Loans: Some lenders may offer larger amounts if you provide security.

- onsolidation Loans for Bad Credit: Some lenders focus more on affordability than credit history. If needed, explore bad credit loan options.

What are the benefits of consolidating debt?

- It may help reduce missed payments.

- It can help you plan repayments more clearly.

- It may reduce monthly repayment depending on lender terms.

Are there any disadvantages?

- Longer repayment terms can increase total interest paid over time.

- Some lenders charge initiation and monthly service fees.

- Missing repayments can negatively affect your credit record.

Will debt consolidation affect my credit score?

Some lenders may run a credit check during the application process. This can temporarily affect your credit score. However, making repayments on time may improve your credit profile over time.

How do I apply for a consolidation loan?

The process is simple. You complete an online form, submit supporting documents, and review available lender options. Always read the loan agreement carefully before accepting any offer.

Ready to consolidate your debt?

If you want to simplify your repayments, you can apply online through FatCat Loans. We help you review available lenders and choose a repayment plan that suits your budget.

Representative example: FatCat Loans is an online loan comparison tool and not a credit provider. We only work with NCR-registered credit providers in South Africa. Our comparison service to consumers is free of charge. Estimated repayments on a loan of R30,000 over 36 months at a maximum annual interest rate of 28% would be R1,360 per month including an initiation fee and monthly service fees. Interest rates charged by credit providers may, however, start as low as 11%. Repayment terms can range from 6 to 72 months.